In the ultimate 12 months of depreciation, the amount could have to be restricted so as to stop on the salvage worth. Monetary analysts will create a depreciation schedule when performing monetary modeling to trace the entire depreciation over an asset’s life. The book worth of an organization is the quantity of owner’s or stockholders’ fairness.

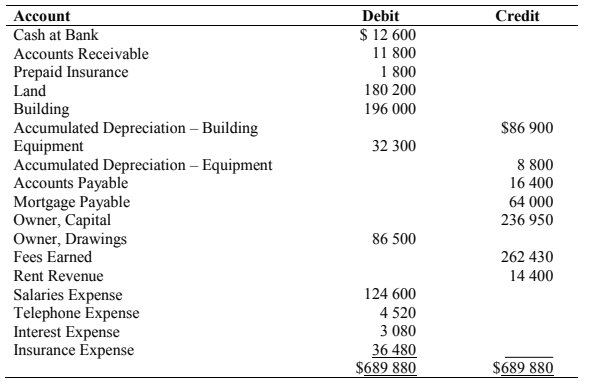

The balance sheet reviews the property, liabilities, and owner’s (stockholders’) fairness at a particular time limit, corresponding to December 31. The stability sheet can be known as the Assertion of Monetary Position. After an asset’s depreciation is recorded as a lot as the date the asset is sold, the asset’s e-book worth is compared to the quantity received. For instance, if an old delivery truck is bought and its cost was $80,000 and its accumulated depreciation at the date of the sale is $72,000, the truck’s book worth on the date of the sale is $8,000.

Examples embrace cash, investments, accounts receivable, inventory, supplies, land, buildings, gear, and vehicles. When a depreciable asset is sold (as against traded-in or exchanged for another asset), a gain or loss on the sale is in all probability going. However, earlier than computing the achieve or loss, it’s necessary to report the asset’s depreciation right up to date of the sale.

Importance Of Accrued Depreciation In Monetary

The first step for the retailer is to record the depreciation for the three weeks that the truck was used in January. The “sum-of-the-years’-digits” refers to adding the digits within the years of an asset’s useful life. For example, if an asset has a useful lifetime of 5 years, the sum of the digits 1 through 5 is equal to 15 (1 + 2 + three + four + 5).

Running Complete Method

Small businesses use this technique for property that wear out steadily, like office furnishings, buildings, and equipment. The four strategies allowed by usually accepted accounting principles (GAAP) are the aforementioned straight-line, together with declining balance, sum-of-the-years’ digits (SYD), and units of manufacturing. Included are the income statement accounts (revenues, expenses, features, losses), abstract accounts (such as earnings summary), and a sole proprietor’s drawing account. You should contemplate our materials to be an introduction to chose accounting and bookkeeping subjects (with complexities probably omitted). We focus on monetary assertion reporting and do not discuss how that differs from income tax reporting.

This amassed amount is subtracted from the original asset value to current the asset’s guide worth or web carrying value. For instance, if tools initially cost $50,000 with $20,000 in amassed depreciation, the book worth would present as $30,000. Amassed depreciation is reported on the steadiness sheet as a unfavorable number within the asset section, lowering the overall value of the fastened belongings owned by the company.

To illustrate the worth of an asset, assume that an organization paid $10,000 to buy used equipment positioned 200 miles away. Lastly, the company paid $5,000 to get the tools in working condition. The firm will report the equipment in its common ledger account Equipment at the cost of $17,000. Imagine a marketing agency buying workplace furnishings for $20,000 with an expected useful life of 10 years. Utilizing straight-line depreciation, the corporate information $2,000 in depreciation expense annually. Depreciation relies on the asset’s usage or output, similar to machine hours or items produced.

Accumulated depreciation is the sum of the depreciation bills for an asset for every reporting interval that the corporate owned that asset. Beneath double declining stability, you take double the straight-line proportion rate every year by the guide worth until you attain the salvage value. Unlike straight-line depreciation, you do not have https://www.simple-accounting.org/ to subtract salvage value from the acquisition value prior to calculating depreciation. The e-book worth starts at the acquisition worth after which is recalculated yearly after the depreciation expense is taken.

All data prepared on this website is for informational functions only, and shouldn’t be relied on for legal, tax or accounting recommendation. You ought to seek the guidance of your individual authorized, tax or accounting advisors earlier than participating in any transaction. The content on this web site is supplied “as is;” no representations are made that the content material is error-free. As a non-cash expense, it lowers your profits with out affecting cash circulate.

- This helps businesses and stakeholders perceive the asset’s remaining useful life, current value, and contribution to operations.

- This entails a debit to the depreciation expense account and a credit score to the amassed depreciation account.

- For instance, you probably can create detailed depreciation schedules that offer you a transparent view of mounted asset values and improve the accuracy of your monetary reporting.

- While you record the contra asset alongside your other assets, it always has a adverse value, displaying how accrued depreciation reduces an asset’s value from its original price.

- Utilizing the straight-line technique, an asset costing $10,000 with a salvage value of $2,000 and a useful life of 5 years would have an annual depreciation expense of $1,600.

Monitoring the depreciation expense of an asset is necessary for accounting and tax reporting purposes because it spreads the cost of the asset over the time it’s in use. For instance, Amassed Depreciation is a contra asset account, as a result of its credit score steadiness is contra to the debit stability for an asset account. This is an owner’s fairness account and as such you’ll count on a credit score steadiness.

On the other hand, depreciation bills represent the assigned portion of a company’s mounted property value for a particular period. These expenses are acknowledged on the revenue assertion as non-cash bills that reduce the company’s web income or profit. From an accounting standpoint, the depreciation expense is debited, whereas the accumulated depreciation is credited. Although amassed depreciation itself does not appear on the earnings assertion, annual depreciation expenses do.